## 编译环境

操作系统

* [ ] Windows 7/8/10

* [ ] macOS

* [ ] Linux

`若需勾选,请把[ ]改成[x]`

Tex发行版

* [ ] TexLive `年份`

* [ ] MikTeX `版本号`

* [ ] CTeX

`若需勾选,请把[ ]改成[x]`

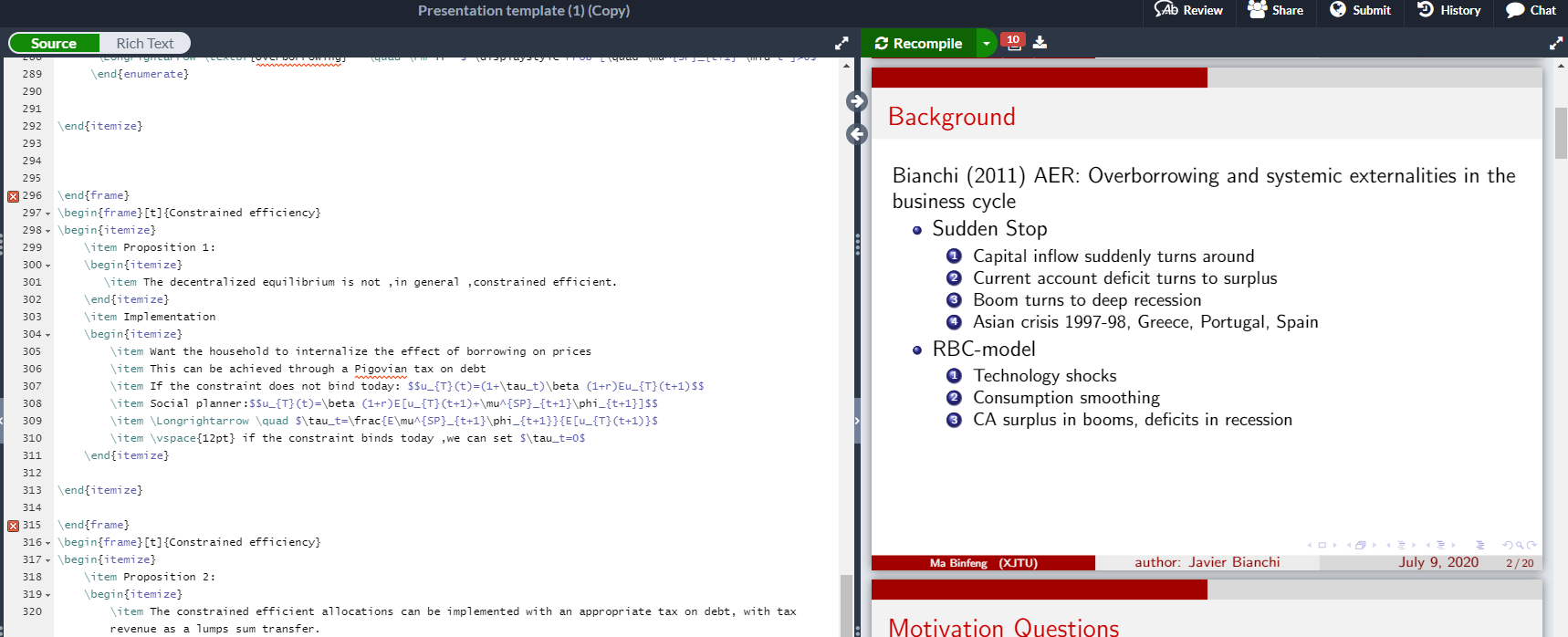

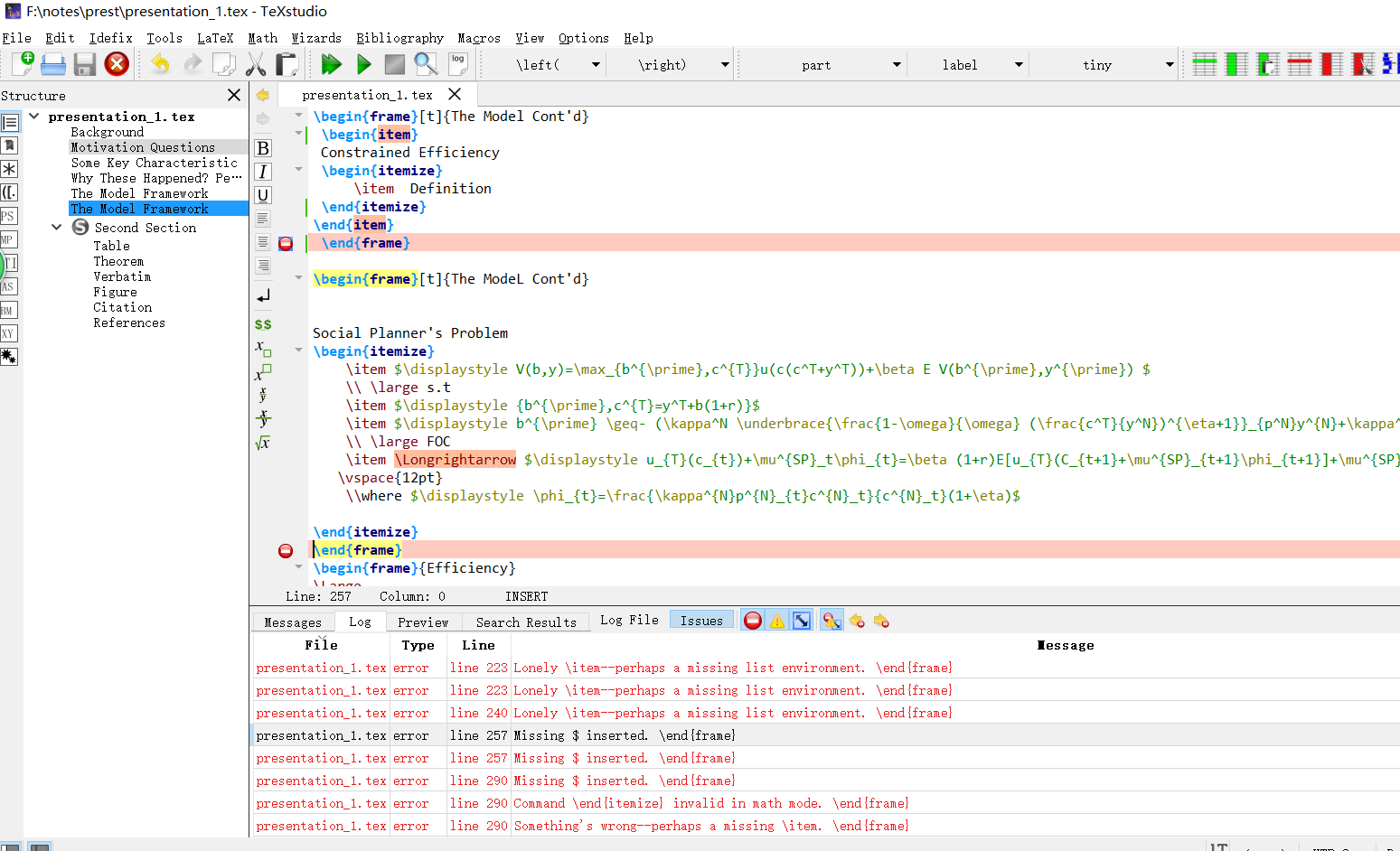

## 我的问题

我在overleaf上的beamer网上能编译出来,但是下载在电脑上就出不来了,这是怎么回事呢

% Beamer Presentation!

% LaTeX Template

% Version 1.0 (10/11/12)

%

% This template has been downloaded from:

% http://www.LaTeXTemplates.com

%

% License:

% CC BY-NC-SA 3.0 (http://creativecommons.org/licenses/by-nc-sa/3.0/)

%

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

%----------------------------------------------------------------------------------------

% PACKAGES AND THEMES

%----------------------------------------------------------------------------------------

\documentclass{beamer}

\mode {

% The Beamer class comes with a number of default slide themes

% which change the colors and layouts of slides. Below this is a list

% of all the themes, uncomment each in turn to see what they look like.

%\usetheme{default}

%\usetheme{AnnArbor}

%\usetheme{Antibes}

%\usetheme{Bergen}

%\usetheme{Berkeley}

%\usetheme{Berlin}

%\usetheme{Boadilla}

\usetheme{CambridgeUS}

%\usetheme{Copenhagen}

%\usetheme{Darmstadt}

%\usetheme{Dresden}

%\usetheme{Frankfurt}

%\usetheme{Goettingen}

%\usetheme{Hannover}

%\usetheme{Ilmenau}

%\usetheme{JuanLesPins}

%\usetheme{Luebeck}

%\usetheme{Madrid}

%\usetheme{Malmoe}

%\usetheme{Marburg}

%\usetheme{Montpellier}

%\usetheme{PaloAlto}

%\usetheme{Pittsburgh}

%\usetheme{Rochester}

%\usetheme{Singapore}

%\usetheme{Szeged}

%\usetheme{Warsaw}

% As well as themes, the Beamer class has a number of color themes

% for any slide theme. Uncomment each of these in turn to see how it

% changes the colors of your current slide theme.

%\usecolortheme{albatross}

%\usecolortheme{beaver}

%\usecolortheme{beetle}

%\usecolortheme{crane}

%\usecolortheme{dolphin}

%\usecolortheme{dove}

%\usecolortheme{fly}

%\usecolortheme{lily}

%\usecolortheme{orchid}

%\usecolortheme{rose}

%\usecolortheme{seagull}

%\usecolortheme{seahorse}

%\usecolortheme{whale}

%\usecolortheme{wolverine}

%\setbeamertemplate{footline} % To remove the footer line in all slides uncomment this line

%\setbeamertemplate{footline}[page number] % To replace the footer line in all slides with a simple slide count uncomment this line

%\setbeamertemplate{navigation symbols}{} % To remove the navigation symbols from the bottom of all slides uncomment this line

}

\usepackage{amsfonts,amsmath,amssymb}

\usepackage{graphicx} % Allows including images

\usepackage{booktabs} % Allows the use of \toprule, \midrule and \bottomrule in tables

%----------------------------------------------------------------------------------------

% TITLE PAGE

%----------------------------------------------------------------------------------------

\title[\scriptsize author: Javier Bianchi]{Overborrowing and Systemic Externalities in the Business Cycle}

% The short title appears at the bottom of every slide, the full title is only on the title page

\subtitle{\color{black}Bianchi AER(2011)}

\author{Ma Binfeng } % Your name

\institute[XJTU] % Your institution as it will appear on the bottom of every slide, may be shorthand to save space

{Dept of Fin $\&$ Econ \qquad XJTU \\ % Your institution for the title page

\medskip

\textit{john@smith.com} % Your email address

}

\date{\scriptsize\today} % Date, can be changed to a custom date

\begin{document}

\begin{frame}

\titlepage % Print the title page as the first slide

\end{frame}

\begin{frame}[t]\frametitle{Background}\vspace{1pt}

\large Bianchi (2011) AER: Overborrowing and systemic externalities in the business cycle

\begin{itemize}

\item Sudden Stop

\begin{enumerate}

\item Capital inflow suddenly turns around

\item Current account deficit turns to surplus

\item Boom turns to deep recession

\item Asian crisis 1997-98, Greece, Portugal, Spain

\end{enumerate}

\item RBC-model

\begin{enumerate}

\item Technology shocks

\item Consumption smoothing

\item CA surplus in booms, deficits in recession

\end{enumerate}

\end{itemize}

\end{frame}

\begin{frame} \frametitle{Motivation Questions}\vspace{10pt} % Table of contents slide, comment this block out to remove it

%\tableofcontents % Throughout your presentation, if you choose to use \section{} and \subsection{} commands, these will automatically be printed on this slide as an overview of your presentation

\begin{enumerate}

\Large

\item Are sudden stop (constrained) efficient?

\item Through which policies can governments implement the efficient amount of borrowing?

\item How likely and how severe would financial crises be in an efficient equilibrium?

\end{enumerate}

\end{frame}

%----------------------------------------------------------------------------------------

% PRESENTATION SLIDES

%----------------------------------------------------------------------------------------

%------------------------------------------------

%\section{Are sudden stop (constrained) efficient?} % Sections can be created in order to organize your presentation into discrete blocks, all sections and subsections are automatically printed in the table of contents as an overview of the talk

%------------------------------------------------

% A subsection can be created just before a set of slides with a common theme to further break down your presentation into chunks

\begin{frame}

\frametitle{Some Key Characteristic}

\begin{itemize}

\item Debt is often leveraged in nontradable income or assets

\item Borrowing limits depend on prices in the nontradable good sector

\item These prices are endogenous and depend on the households' behavior

\item Households are price-taker and don't internalize effects on borrowing constraints

\item Alternative explanation for over-borrowing:Moral Hazard(e.g., Schneider and Tornell(2004))

\end{itemize}

\end{frame}

%------------------------------------------------

\begin{frame}

\frametitle{Why These Happened? Perhaps:}

\begin{itemize}

\item Incomplete markets, only safe bond, no insurance

\item Moral hazard, difficulty collecting debt payments

\item Lenders limit borrowing relative to income

\item Consumers sometimes borrow up to the limit

\item If a bad shock hits, the limit is reduced and consumers forced to save

\item Increased saving reduces the price of non-traded goods Even lower limit

\item Over-borrowing: One person's borrowing contribute to reduce the limit for all

\end{itemize}

\end{frame}

%------------------------------------------------

\begin{frame}

%\frametitle{Blocks of Highlighted Text}

\frametitle[t]{The Model Framework}

\begin{itemize}

\item SOE DSGE model with aggregate borrowing limit (Mendoza, 2002)

\item Stochastic endowments of tradable and nontradable goods

\item Consumers maxmize $\displaystyle E\sum ^{\infty }_{t=0}\beta ^{t} u(c_t) $

\item $\displaystyle c_{t} =\left[ \omega \left( c^{T}_{t}\right)^{-\eta } +( 1-\omega )\left( c^{N}_{t}\right)^{-\eta }\right]^{-\frac{1}{\eta }}$,\quad $\eta>-1,\omega\in (0,1)$

\item Endowment:$y=(y^N , y^T)$ follows Markov process

\item Only asset:riskless bond, traded at constant $\displaystyle r,\beta(1+r)<1$

\item $\displaystyle b_{t+1}+c^{T}_{t}+p^{N}_{t}c^{N}_{t}=b_{t}(1+r)+y^{T}_{t}+p^{N}_{t}y^{N}_{t}$

\end{itemize}

%\begin{block}{Block 1}

%Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer lectus nisl, ultricies in feugiat rutrum, porttitor sit amet augue. Aliquam ut tortor mauris. Sed volutpat ante purus, quis accumsan dolor.

%\end{block}

%\begin{block}{Block 2}

%\end{block}

%\begin{block}{Block 3}

%\end{block}

\end{frame}

%------------------------------------------------

\begin{frame}

\frametitle [t]{The Model Framework}

Credit constraint:$b_{t+1}\geq -(\kappa^{N}p^{N}_{t}y^{N}_t+\kappa^{T}y^{N}_{t})$

%\begin{columns}[c] % The "c" option specifies centered vertical alignment while the "t" option is used for top vertical alignment

\begin{itemize}

\item $\kappa^{N}>0$ empirically relevant (Tornell and Westermann,2005)

\item Collateral is determined by {\color{red}current} income

\end{itemize}

\begin{item}

Equilibrium

\item Optimal decisions require:

\begin{itemize}

\item $u_{T}(c_t)=\beta (1+r)Eu_{T}(c_{t+1}+\mu_{t}$

\item $b_{t+1}\geq -(\kappa^{N}p^{N}_{t}y^{N}_t+\kappa^{T}y^{N}_{t})$

\item $\displaystyle p^{N}_t=(\frac{1-\omega}{\omega})(\frac{c^{T}_t}{c^{N}_t})^{\eta+1}$

\end{itemize}

\item Market clearing:

\begin{itemize}

\item $ c^{N}_t=y^{N}_t$

\item $c^{T}_t=y^{T}_t+b_{t}(1+r)-b_{t+1} $

\end{itemize}

\item Is the resulting allocation efficient?

\end{item}

\end{frame}

%\column{.45\textwidth} % Left column and width

%\textbf{Heading}

%\column{.5\textwidth} % Right column and width

%Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer lectus nisl, ultricies in feugiat rutrum, porttitor sit amet augue. Aliquam ut tortor mauris. Sed volutpat ante purus, quis accumsan dolor.

%\end{columns}

\begin{frame}[t]{The Model Cont'd}

\begin{item}

Constrained Efficiency

\begin{itemize}

\item Definition

\end{itemize}

\end{item}

\end{frame}

\begin{frame}[t]{The ModeL Cont'd}

Social Planner's Problem

\begin{itemize}

\item $\displaystyle V(b,y)=\max_{b^{\prime},c^{T}}u(c(c^T+y^T))+\beta E V(b^{\prime},y^{\prime}) $

\\ \large s.t

\item $\displaystyle {b^{\prime},c^{T}=y^T+b(1+r)}$

\item $\displaystyle b^{\prime} \geq- (\kappa^N \underbrace{\frac{1-\omega}{\omega} (\frac{c^T}{y^N})^{\eta+1}}_{p^N}y^{N}+\kappa^{T}y^{T})$

\\ \large FOC

\item \Longrightarrow $\displaystyle u_{T}(c_{t})+\mu^{SP}_t\phi_{t}=\beta (1+r)E[u_{T}(C_{t+1}+\mu^{SP}_{t+1}\phi_{t+1}]+\mu^{SP}_t$,

\vspace{12pt}

\\where $\displaystyle \phi_{t}=\frac{\kappa^{N}p^{N}_{t}c^{N}_t}{c^{N}_t}(1+\eta)$

\end{itemize}

\end{frame}

\begin{frame}{Efficiency}

\Large

Consider the following 3 cases:

\begin{enumerate}

\item The credit constraint is binding today

\item The household is not constrained today but may be constrained tomorrow

\item The constraint will not bind tomorrow

\end{enumerate}

\end{frame}

\begin{frame}[t]{Efficiency}

The credit constraint is binding today

\begin{itemize}

\item Shadow price of wealth for the social planner:$$u_{T}(c_{t})+\mu^{SP}_t\phi_{t}$$

\Longrightarrow \textbf{The private agent undervalue wealth}

\end{itemize}

The household is not constrained today but may be constrained tomorrow

\begin{itemize}

\item Compare Euler equations

\begin{enumerate}

\item Decentralized equilibrium :$$u_{T}(t)=\beta (1+r)Eu_{T}(t+1)$$

\item Social planner: $$u_{T}(t)=\beta (1+r)E[u_{T}(t+1)+\mu^{SP}_{t+1}\phi_{t+1}]$$

\Longrightarrow \textbf{Overborrowing} \quad \rm if $ \displaystyle Prob [\quad \mu^{SP}_{t+1} \mid t ]>0$

\end{enumerate}

\end{itemize}

\end{frame}

\begin{frame}[t]{Constrained efficiency}

\begin{itemize}

\item Proposition 1:

\begin{itemize}

\item The decentralized equilibrium is not ,in general ,constrained efficient.

\end{itemize}

\item Implementation

\begin{itemize}

\item Want the household to internalize the effect of borrowing on prices

\item This can be achieved through a Pigovian tax on debt

\item If the constraint does not bind today: $$u_{T}(t)=(1+\tau_t)\beta (1+r)Eu_{T}(t+1)$$

\item Social planner:$$u_{T}(t)=\beta (1+r)E[u_{T}(t+1)+\mu^{SP}_{t+1}\phi_{t+1}]$$

\item \Longrightarrow \quad $\tau_t=\frac{E\mu^{SP}_{t+1}\phi_{t+1}}{E[u_{T}(t+1)}$

\item \vspace{12pt} if the constraint binds today ,we can set $\tau_t=0$

\end{itemize}

\end{itemize}

\end{frame}

\begin{frame}[t]{Constrained efficiency}

\begin{itemize}

\item Proposition 2:

\begin{itemize}

\item The constrained efficient allocations can be implemented with an appropriate tax on debt, with tax revenue as a lumps sum transfer.

\end{itemize}

\item Implementation

\begin{itemize}

\item Constrained efficient allocations can also be implemented with margin constraint $\theta_t$

\item $ $b_{t+1}\geq -(1-\theta_t)(\kappa^{N}p^{N}_{t}y^{N}_t+\kappa^{T}y^{N}_{t})$ ,\\ \vspace{12pt} where $\displaystyle \theta_t=1-\frac{b^{SP}_t}{(\kappa^{N}p^{N}_{t}y^{N}_t+\kappa^{T}y^{N}_{t})}$

\item \vspace{12pt} This restricts borrowing to the socially optimal amount and therefor restores constrained efficiency

\end{itemize}

\end{itemize}

\end{frame}

%------------------------------------------------

\section{Second Section}

%------------------------------------------------

\begin{frame}

\frametitle{Table}

\begin{table}

\begin{tabular}{l l l}

\toprule

\textbf{Treatments} & \textbf{Response 1} & \textbf{Response 2}\\

\midrule

Treatment 1 & 0.0003262 & 0.562 \\

Treatment 2 & 0.0015681 & 0.910 \\

Treatment 3 & 0.0009271 & 0.296 \\

\bottomrule

\end{tabular}

\caption{Table caption}

\end{table}

\end{frame}

%------------------------------------------------

\begin{frame}

\frametitle{Theorem}

\begin{theorem}[Mass--energy equivalence]

$E = mc^2$

\end{theorem}

\end{frame}

%------------------------------------------------

\begin{frame}[fragile] % Need to use the fragile option when verbatim is used in the slide

\frametitle{Verbatim}

\begin{example}[Theorem Slide Code]

\begin{verbatim}

\begin{frame}

\frametitle{Theorem}

\begin{theorem}[Mass--energy equivalence]

$E = mc^2$

\end{theorem}

\end{frame}\end{verbatim}

\end{example}

\end{frame}

%------------------------------------------------

\begin{frame}

\frametitle{Figure}

Uncomment the code on this slide to include your own image from the same directory as the template .TeX file.

%\begin{figure}

%\includegraphics[width=0.8\linewidth]{test}

%\end{figure}

\end{frame}

%------------------------------------------------

\begin{frame}[fragile] % Need to use the fragile option when verbatim is used in the slide

\frametitle{Citation}

An example of the \verb|\cite| command to cite within the presentation:\\~

This statement requires citation \cite{p1}.

\end{frame}

%------------------------------------------------

\begin{frame}

\frametitle{References}

\footnotesize{

\begin{thebibliography}{99} % Beamer does not support BibTeX so references must be inserted manually as below

\bibitem[Smith, 2012]{p1} John Smith (2012)

\newblock Title of the publication

\newblock \emph{Journal Name} 12(3), 45 -- 678.

\end{thebibliography}

}

\end{frame}

%------------------------------------------------

\begin{frame}

\Huge{\centerline{The End}}

\end{frame}

%----------------------------------------------------------------------------------------

\end{document}

一周热门 更多>